The Canadian Dental Care Plan (CDCP) is designed to help households without workplace dental coverage. Excluding dental from Health Spending Accounts (HSAs) to try to qualify employees for the Canadian Dental Care Plan is risky, misleading, and can harm employees. Kibono explains why.

What CRA guidance actually says

The Canada Revenue Agency (CRA) has been clear in its guidance: if an HSA reimburses dental expenses, that HSA is treated as providing dental coverage. That means employees are not eligible for the Canadian Dental Care Plan. Conversely, if an employer deliberately excludes dental from the HSA, it may no longer be considered dental coverage and employees could technically become eligible for the Canadian Dental Care Plan.

Those mechanics exist on paper — but they don’t make exclusion a good or defensible business practice.

1. HSAs exist to provide flexibility — not loopholes

An HSA (a Private Health Services Plan under the Income Tax Act) is designed for flexible, employer-funded budgets that employees apply toward eligible medical expenses — including dental. If budgets are tight, employers can scale the HSA limit (for example $2,000 → $1,000 → $500), and employees still choose how to use the funds. HSAs were never intended to be engineered to exploit eligibility for the Canadian Dental Care Plan.

Kibono: “Cutting out dental just to sidestep eligibility for the Canadian Dental Care Plan isn’t clever plan design — it’s bad faith.”

2. This undermines the spirit of the Canadian Dental Care Plan

The Canadian Dental Care Plan exists to help households that truly lack workplace dental benefits. It isn’t meant to be a taxpayer subsidy for employers who want to advertise benefits while shifting dental costs to the public. Intentionally gutting dental coverage to push employees toward the Canadian Dental Care Plan is gaming the system — shifting costs and removing real choice for employees.

3. Employers don’t need tricks — they need transparency

Short-term cost-shifting by removing dental from an HSA doesn’t actually help employees. It forces them into a patchwork of partial public programs and out-of-pocket expenses. Because Canadian Dental Care Plan eligibility depends on household income, provider participation, and evolving government rules, employees could end up worse off.

- Reduce the HSA limit if budgets are tight — don’t carve out dental as a loophole.

- Communicate changes clearly so employees understand what’s covered privately vs. publicly.

- Remember: transparency preserves trust; gimmicks undermine it.

4. The bigger problem: how the Canadian Dental Care Plan is administered

There are reasonable criticisms of how the Canadian Dental Care Plan has been structured and administered — for example, outsourcing administration to private insurers rather than using simpler, existing systems. Those are valid policy conversations. But they don’t justify employers deliberately excluding dental from HSAs to create apparent eligibility for the Canadian Dental Care Plan.

“Employers shouldn’t rely on loopholes to design benefits. They should rely on fairness and clarity.” — Kibono Benefits Team

5. Kibono’s view: don’t design benefits to game a public program

Advisors actively recommending exclusion of dental from HSAs to make employees eligible for the Canadian Dental Care Plan are encouraging a practice that looks a lot like cost-shifting and omission-based risk. It’s misleading, it damages employee trust, and it exposes employers to reputational risk.

At Kibono, our recommendation is simple:

- Set an HSA budget you can sustainably afford.

- Let employees decide how to use the HSA funds.

- Keep plan design transparent — don’t carve out categories to chase eligibility rules.

Final word

The Canadian Dental Care Plan is an important program for households without workplace dental coverage. However, deliberately stripping dental from HSAs to push employees onto the Canadian Dental Care Plan is not innovation — it’s manipulation and borderline fraud. The legislation is clear: HSAs are to cover all medical expenses, not just the ones you choose as the employer.

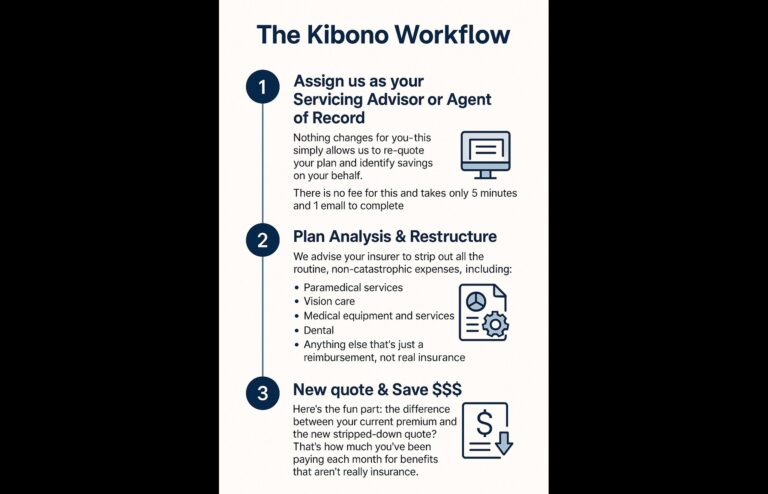

If you’re reconsidering how to structure benefits in light of the Canadian Dental Care Plan, talk to Kibono. As a trusted advisor to employers, we’ll help you design HSA and benefits programs that are compliant, fair, and focused on employee outcomes.