If you’re a self-employed shareholder, setting up a Health Spending Account (HSA) can seem like a savvy tax-saving move. But without a proper salary structure, you might be inviting serious trouble from the Canada Revenue Agency (CRA). One client recently asked:

“We’re selling our operating business and plan to pay ourselves about $3,500 each per year from our Holdco. Can we still set up an HSA for $7,000 in medical expenses?”

The short answer? Not unless you want to poke the CRA bear.

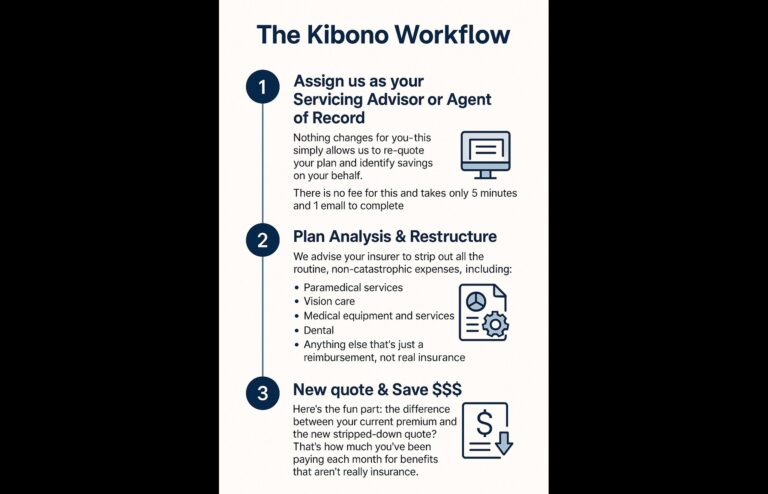

🧩 HSAs Aren’t the Problem—Your Salary Might Be

For self-employed shareholders, the CRA has one main concern: Are you an actual employee, or just calling yourself one?

HSAs are meant for employees, not business owners paying themselves token amounts. According to CRA’s guidance on PHSPs, eligibility hinges on being a legitimate employee.

🏛️ CRA’s HSA Rules: Still Murky After 20+ Years

One would think CRA could just say, “You can spend X% of your T4 salary on an HSA, and that’s it.” But no such luck. Instead, self-employed shareholders must interpret unclear, sometimes contradictory guidance.

😡 The Industry Is Part of the Problem

Third-party vendors are selling high-limit HSAs without verifying if business owners are even on payroll. Some let you claim $10K+ while paying yourself nothing. That’s not pushing the envelope—that’s torching it.

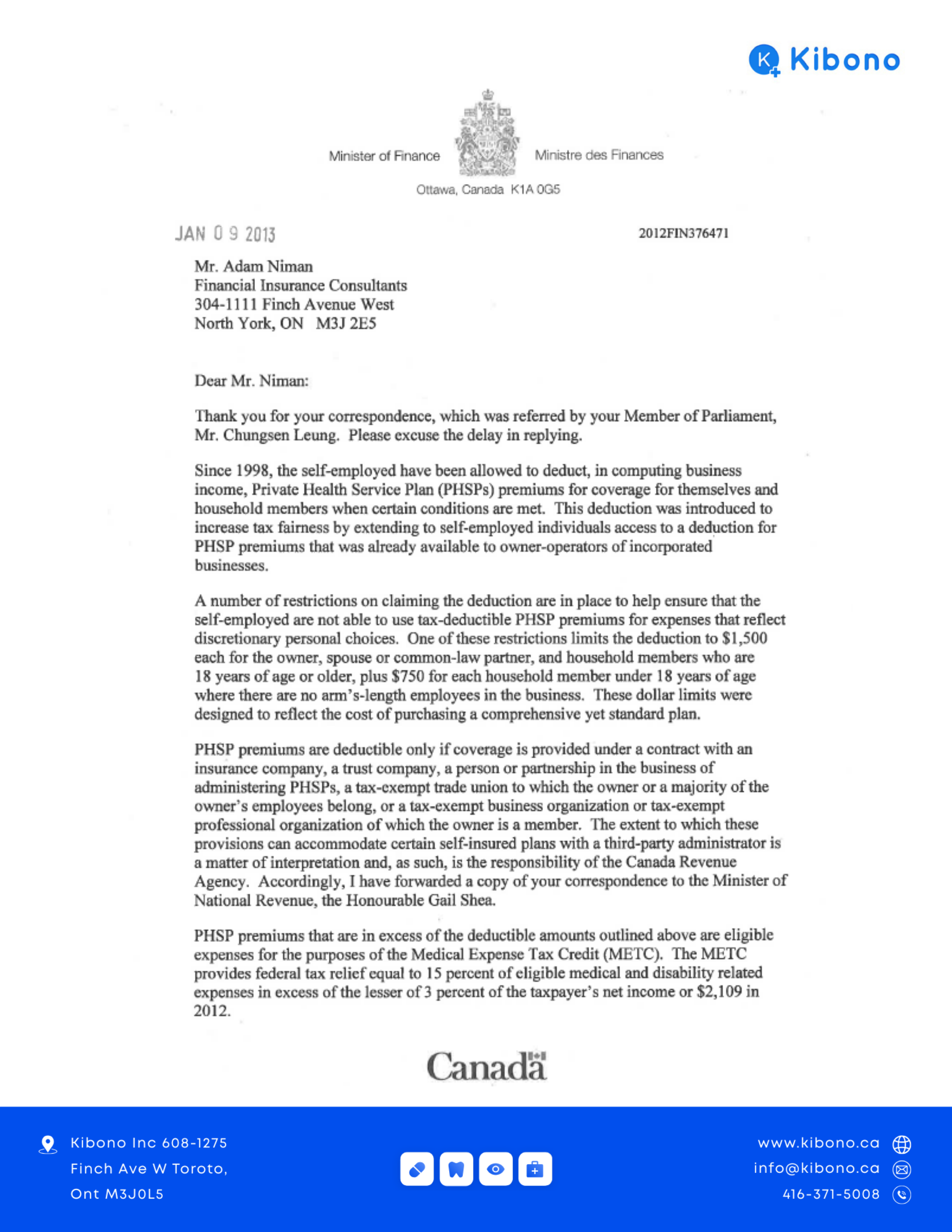

📜 A History Lesson: The 1998 Income Tax Act Update

In 1998, the Income Tax Act was amended to allow sole proprietors to access PHSPs. But with restrictions:

- $1,500 per adult (owner and spouse)

- $750 per child under 18

✉️ A Word from the Late Jim Flaherty

In 2013, then–Finance Minister Jim Flaherty confirmed that the intent was to extend fairness to self-employed individuals through these plans—within reason.

🐄 Cows Get Fat. Pigs Get Slaughtered.

A properly set up HSA is a great benefit for self-employed shareholders when used responsibly. But abusing the system paints a bullseye for the CRA.

“This is about saving some tax, not extracting every last dollar from your corporation tax-free.”

Need Help? Let’s Talk.

Still unsure how this applies to your setup as a self-employed shareholder? Reach out today. We’ll walk you through your options—before CRA does.

Further Reading

Canada Revenue Agency – Health Spending Accounts

Income Tax Act – Justice Laws Website

The Globe and Mail – Business Owners & HSA