🇨🇦 Supporting Canada extends to employee health benefit plans

With rising tensions in Canada–U.S. trade, patriotic support for local businesses is reaching new heights. Canadian small business owners now face a critical choice: continue sending money to U.S.-linked financial giants, or invest in Canadian small business health benefits that support local innovation like Kibono.

If you’ve been tied to multinational giants like Sun Life, Manulife, or Canada Life, you’ve probably seen premiums skyrocket while your flexibility shrinks. Kibono offers a smarter alternative, built for Canadian entrepreneurs—without bloated overhead or commissions.

💔 The Broken Promise of Traditional Group Health Benefits

Bundled group benefits combine routine and catastrophic care—driving up premiums and creating financial traps for small businesses. One user on Reddit wrote:

“The solution is standalone insurance and a pay-per-claim HSA. Most HSAs charge 10–15%, but Kibono only charges 5% and offers same-day setup.”

Traditional insurers profit from rising claims—leaving business owners with less predictability and more expense.

👍 Enter Kibono: Empowering Canadian Businesses with Fairness

Kibono redefines Canadian small business health benefits through transparency and control:

- No monthly premiums

- Only $2.25 + 5.25% per claim

- No impact on insurance premiums

- 100% Tax-deductible

It’s the modern way to deliver health benefits—built for small business budgets, without sacrificing employee value.

🇨🇦 A Canadian Story: Supporting Our Own

Kibono is proudly 100% Canadian. When you partner with them, you’re fueling a grassroots ecosystem that helps Canadian jobs, families, and communities—not corporate profits.

This is more than a financial decision—it’s a national statement. Canadian small business owners deserve a system that works *for* them, not against them.

💡 The HSA Advantage: Efficiency, Transparency, Control

Health Spending Accounts (HSAs) offer a flexible, tax-deductible alternative to group benefits. They allow employees to claim CRA-eligible expenses—like dental, vision, therapy, prescriptions, and even fertility treatments.

As one Reddit user said: “Only 50% of employees actually use their benefits. With Kibono, you only pay for what’s used—nothing more.”

Explore covered benefits here: What Does an HSA Cover?

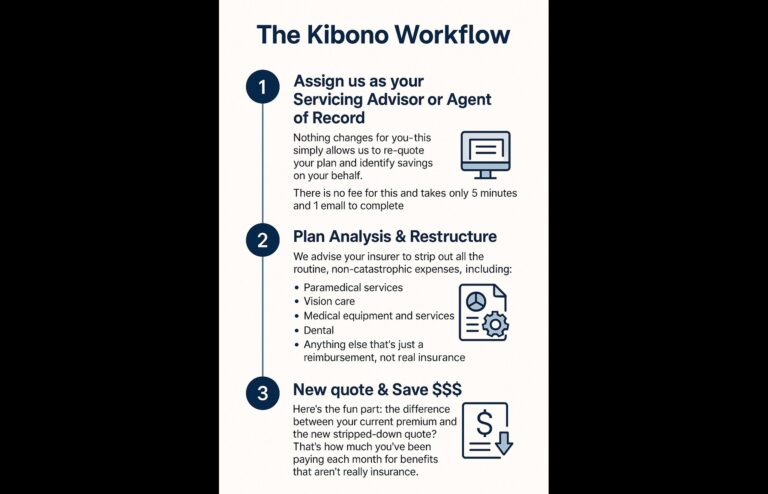

🔁 How Kibono Works in 4 Simple Steps

- Sign up in minutes (no setup fee)

- Choose funding — monthly invoice or prepaid

- Employees claim health expenses easily online

- Pay only for benefits used, saving thousands

Everyday claims no longer inflate insurance costs. Learn more on Kibono’s FAQ page.

🛡️ David’s Sling: Breaking Free From Goliath

- Say goodbye to 30% commissions

- Keep insurance premiums stable

- Grow Canadian jobs

- Provide flexible, top-tier coverage

“Our premiums dropped 50% after switching to Kibono + separate insurance.” — r/SmallBusinessCanada

📣 Join the Movement: Choose Kibono. Choose Canada.

If you’re ready to take control of your benefits—and support Canadian innovation—Kibono is ready for you.

✅ Action Steps

- Audit your group benefits costs

- Compare with Kibono’s pricing

- Start risk-free—no contracts or setup fees

- Spread the word—support Canadian business