Traditional group health benefit plans are designed for profit; not for employer value or flexibility for employees. Unlike Health Spending Accounts, the more claims that employees make, the higher your annual premium becomes each year. Sound all too familiar?

Small-business owners struggle to attract and retain top-talent since comprehensive health plans are far too expensive; a perk that big corporate can afford to splash out on. Without benefits, employees will simply overlook a job posting. As a non-negotiable for employees, even the most basic health plans have become far too expensive; leaving owners little choice but to trim back the perks or remove benefits all together. A move that never goes over very well…How did we end up here? Well, it’s simple. Benefit plans are flawed by design; they are built in a way to cost you more and more every year.

Health benefit plans are flawed by design

Traditional benefit plans bundle routine ‘benefits’ such as prescription drug, dental, optical or medical like massage and physiotherapy; along with ‘insurance’ such as Life or Disability insurance to form a single payable premium.

Why bundling is a terrible idea!

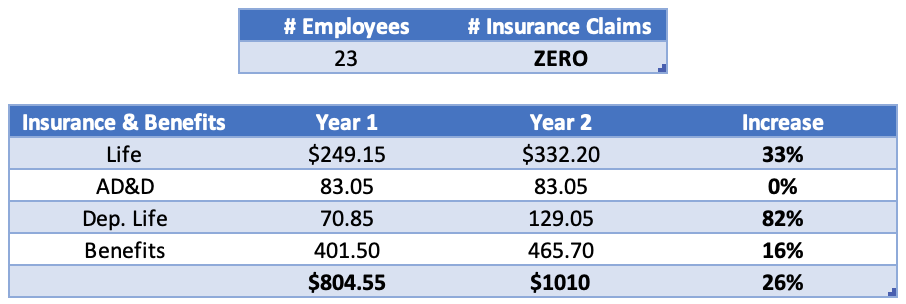

90% or more of employee health claims each year are for routine medical expenses; insurance claims such as Life or Disability are rarely, if ever claimed.

When a plan is structured by bundling ‘benefits’ with ‘insurance’, any employee claim (routine or not) will increase plan usage, increase the perceived ‘risk’ of the plan and will result in a premium increase upon renewal.

A real customer example

Even with ZERO insurance claims, premiums increased by an average of 26%! How does this make sense?

Not a single insurance-related claim yet premiums go up? Sadly this is the same story over and over again.

Learn more about HSA vs. Group Benefit Plans

Why Health Spending Accounts (HSAs) are better than traditional benefit plans

Traditional benefit plans are uncapped with runaway premium increases.

Health Spending Accounts are pay-per-claim up to an amount budgeted by the Employer, providing cost certainty.

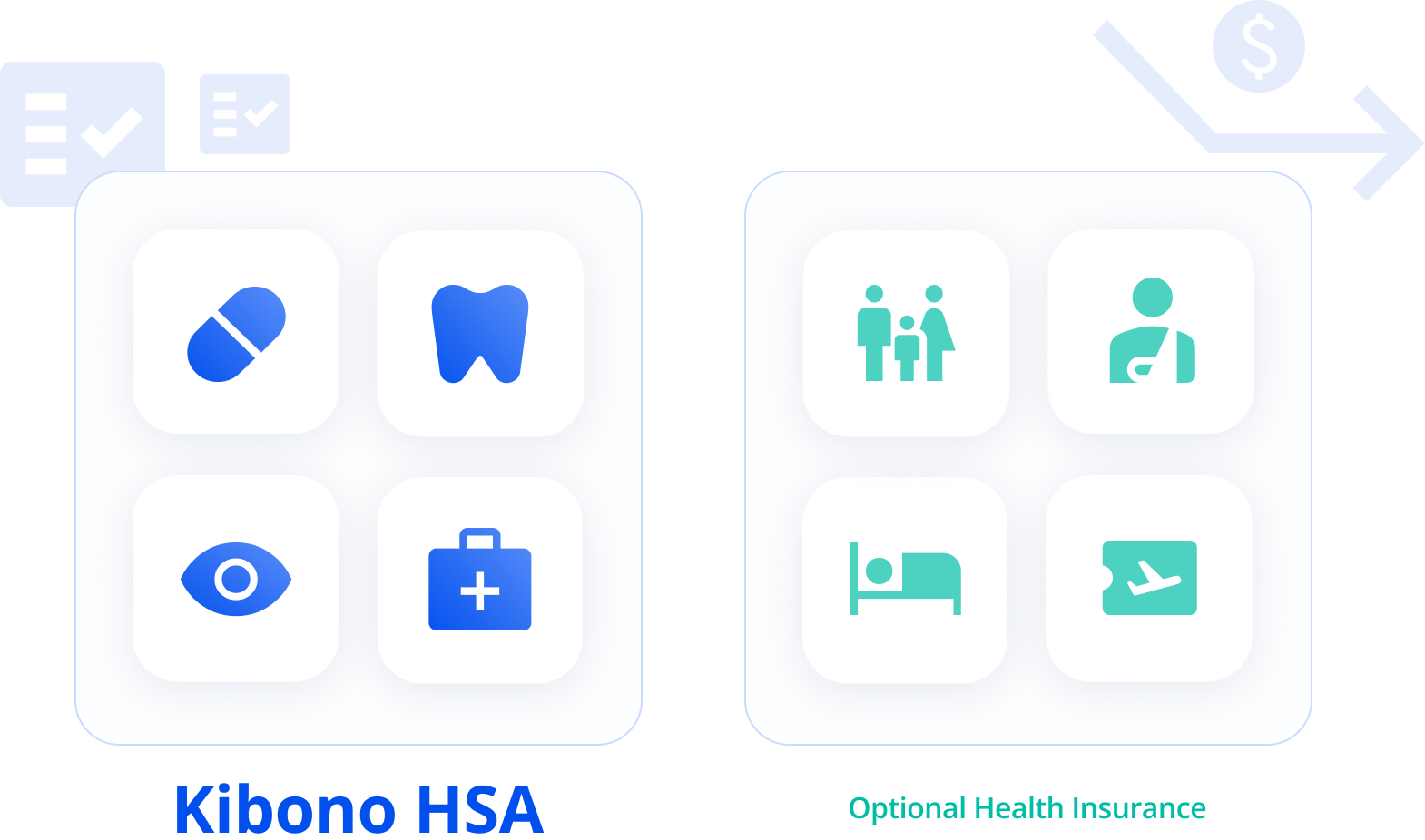

A Kibono Health Spending Account (HSA) transforms routine Drug, Dental, Optical and Medical costs for you and your Employees into a 100% business-tax deduction for a low fixed-fee per claim.

- Pay-per-claim; only pay for what is actually used

- Avoid insurance premium increases all together

- Claims are 100% business-tax deductible

- Non-restrictive & flexible; any CRA medical expense is eligible

A Kibono Health Spending Account (HSA) separates the routine benefit claims from any insurance (i.e. Life or Disability) so that employee dental check ups and massages have zero impact on your insurance premium. With an HSA, each benefit claim simply incurs a low fixed-fee per claim.

Why is this a brilliant idea?

Separating benefits from insurance using an HSA will instantly decrease and stabilise your insurance premiums.

Insurance companies are required to manage ‘risk’. Routine benefits are not a ‘risk’ by their very nature. Therefore, insurance companies should only provide risk-based insurance products such as Life and Disability insurance for you and your employees.

Traditional benefit plans are restrictive. HSAs are not!

Traditional benefit plans create artificial restrictions (for profit!) on employees such as; only 80% of dental check ups are covered, or prescription glasses allowed only every 2 years, or only the first $90 of a massage is allowed. Why?

With a Kibono HSA, the employer sets the annual benefit limit for an employee to spend on any CRA-eligible medical expense. If Bob needs braces and spends all $3,000 on dental? No problem! If Susan really enjoys massages, she can have $3,000 worth if she pleases!

Since any CRA medical expense is eligible with a Kibono HSA, the list of allowable claims is far more extensive than any traditional plan. For example with a Kibono HSA, you can claim any fertility related procedures, laser eye surgery, a CPAP machine, a midwife etc. All things that are either restricted or not allowed under traditional plans!

What can I claim with a Kibono HSA?

View CRA guidelines

Do I still need to purchase Life or Disability insurance with an HSA?

Purchasing insurance is not required. However, we strongly recommend that you purchase Kibono Insurance such as Life or Disability to compliment your Health Spending Account to provide comprehensive coverage for you and your employees.

Purchasing insurance separately is significantly cheaper since insurers can no longer allocate ‘risk’ for routine benefits as those are now handled by your Kibono Health Spending Account on a fixed-fee-per-claim basis.

Kibono offers the following insurance products to supplement your Kibono HSA:

- Life

- Disability

- Critical Illness

- Emergency Medical, Hospital & Travel

Only pay for the benefits used!

- Pay-Per-Claim benefits with no impact on insurance premium

- Claims are 100% business-tax deductible and received tax-free by employees

- Setup a FREE Kibono HSA in minutes; no setup fees, annual fees or lock-in!

Try Kibono’s pricing calculator to know exactly how much your benefits will cost

‘I was unable to offer my employees any health benefits for years. The plans offered by Sunlife and Manulife were far too expensive for us to maintain and highly restrictive. Our premiums always increased each year. With a Kibono HSA, I can offer health benefits with maximum flexibility for my employees with absolute cost certainty. I love the ability to pay-per-claim. If there’s no claims in a month, my bill is simply $0. How good is that?’

Russ Alexander – Ander Consulting

Join thousands of small-business owners who prefer HSAs over traditional group benefit plans

Setup a FREE Kibono HSA in minutes with no setup fees, annual fees or lock-in. All you need to get started is a list of employee names and emails! Setup and begin claiming same-day!