Buying a Health Wellness Plan might feel like the right thing to do for your employees; but it’s not.

If you want to support your employee’s well being; just do it directly. Don’t let an insurance company skim 10–20% off the top to do it for you.

You’ve probably heard it in an insurance pitch:

“We now offer wellness plans for gym memberships, meditation apps, even hockey gear!”

It sounds progressive. It sounds generous.

But let’s be clear: It’s a scam.

Here’s the catch: Wellness Plan expenses are ineligible medical expenses under CRA rules. So once reimbursed, they become taxable.

At Kibono, we draw a firm line between insurance and employee benefits — because the industry deliberately blurs it. That confusion isn’t accidental; it’s strategic. It’s how they sell you products you don’t actually need.

Let’s break it down:

Insurance vs. Benefits: What’s the Difference?

Insurance protects against major life events — like disability, death, or critical illness.

Benefits are simply tax-free reimbursements for CRA-approved medical expenses, usually via a Health Spending Account (HSA).

That’s it. That’s all.

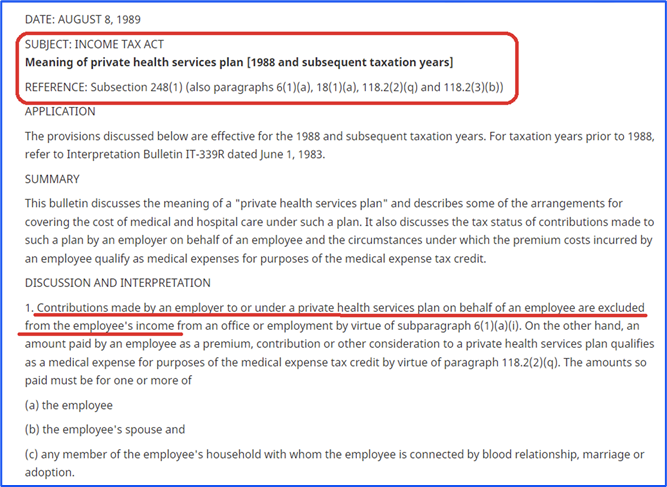

The Real Value: Tax-Free Health Reimbursements

When you pay your employees a salary, it’s taxable.

But when you reimburse them through a third party for a qualified medical expense?

It’s tax-free for them — and 100% deductible for your business.

That’s the real benefit.

The Problem with “Wellness Plans”

What happens when employees don’t claim enough dental or prescription expenses to justify the premiums?

The industry likes to invent value.

They rebrand everyday spending as “wellness.”

Think:

- Gym shoes

- Yoga mats

- Meditation apps

- Skating lessons

Sounds nice — but there’s a catch: These are not medical expenses under CRA rules. So once reimbursed, they become taxable.

That means you’re now paying a third party to process what is essentially taxable payroll, plus fees.

That’s not a benefit. That’s a bad deal dressed in Lycra.

Want to Support Employee Well-Being?

Great. Do it directly.

- Give a bonus

- Fund a class

- Host a wellness week

Just don’t let an insurance company skim 10–20% off the top to do it for you.

Why Kibono Exists

At Kibono, we’re product-agnostic. We don’t sell plans — we simplify them.

We built a platform that helps you escape the annual renewal grind.

Sometimes that means you don’t even need us — and that’s fine.

Because Kibono isn’t just a platform — it’s a mindset.

The name “Kibono” comes from the Latin “Cui bono?”

Translation: Who benefits?

Ask yourself:

Who’s getting paid?

Who’s taking the risk?

Is there a smarter, cheaper, cleaner way to get the same result?

There usually is.

What Does Kibono Offer

We don’t repackage taxable compensation as “wellness.”

We deal in real benefits:

CRA-approved, tax-advantaged health reimbursements. Period.

So the next time someone pitches you a “wellness plan,” ask yourself:

Am I unwell?

Because buying one might just mean you are!

Want to Ditch the Wellness Gimmicks?

Let’s talk.

No sales pitch. Just the truth about employee benefits.

Visit www.kibono.ca to learn more.

Kibono Resources

- Check out www.kibono.ca for more information

- Self-Sign Up or White-Glove Onboarding at no extra charge

- Same-Day setup

- Only $2.25 + 5.25% per claim